I’d like to summarize what I talked about in previous posts.

If you’re a teacher, chances are you’ve heard of a 403(b) — it’s the educator’s version of a 401(k), and it’s one of the best tools available to start investing for retirement. But what if you don’t have access to one? Or what if you’re a part-time teacher, adjunct, or someone in a different profession with no employer-sponsored retirement plan?

Don’t worry — there’s still a simple, effective way to start.

Step 1: Know Your Options

If you do have access to a 403(b) or 457(b), these are powerful accounts to start with because:

- Contributions are pre-tax (you lower your taxable income)

- Your investments grow tax-deferred

- Some employers even offer matching contributions (free money!)

Start by contacting your HR department and asking how to enroll, what investment options are available, and if there are any employer matches.

Step 2: If You Don’t Have a 403(b) or Employer Plan

No problem — you can open your own retirement account called an IRA (Individual Retirement Account). There are two main types:

- Traditional IRA: Contributions are often tax-deductible, and investments grow tax-deferred.

- Roth IRA: You contribute after-tax money, but your investments grow tax-free — and withdrawals in retirement are also tax-free.

If you’re just getting started and expect your income to grow over time, a Roth IRA is a great place to begin.

Step 3: Choose Where to Open Your IRA

You can open an IRA through an online brokerage like:

- Vanguard

- Fidelity

- Charles Schwab

- Betterment or Wealthfront (for more hands-off, automated investing)

Look for low-cost index funds — something like a target-date retirement fund or a total stock market index fund is perfect for beginners.

Step 4: Automate Your Contributions

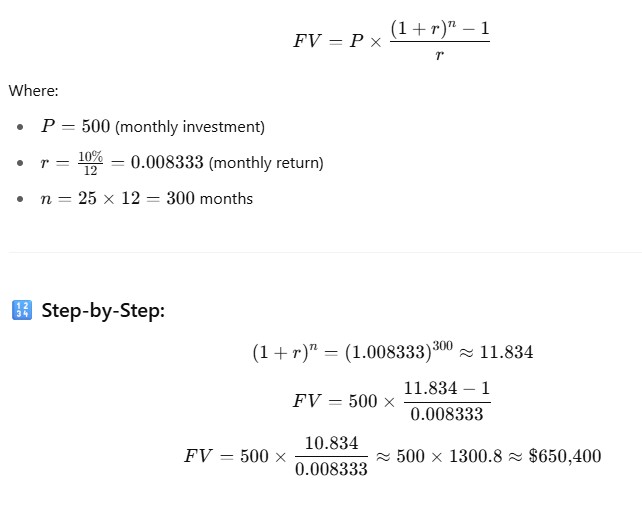

The key to building wealth isn’t timing the market — it’s consistently contributing over time. Try to set up automatic monthly contributions, even if it’s just $50 or $100 to start. As your income grows, you can increase it. You can also increase it by cutting back on unnecessary expenses each week.

Step 5: Stay the Course

Investing can feel overwhelming at first, but you don’t need to be an expert. The most important things are:

- Start as soon as you can

- Keep your costs low (watch for high fees!)

- Don’t panic when the market dips — that’s normal

- Stay consistent

Bonus: Use My Free Calculator

If you want to see how your investments could grow over time — whether in a 403(b), 457(b), or your own IRA — check out my free investment calculator. You can plug in your numbers and get a personalized roadmap to financial independence.

https://professorpayoff.com/retirement-calculator/

Final Thought:

You don’t have to wait until 65 to retire. With a few smart moves and consistent investing, you can create real options for yourself — whether that means retiring early, switching to part-time, or just gaining peace of mind. You’ve got this.